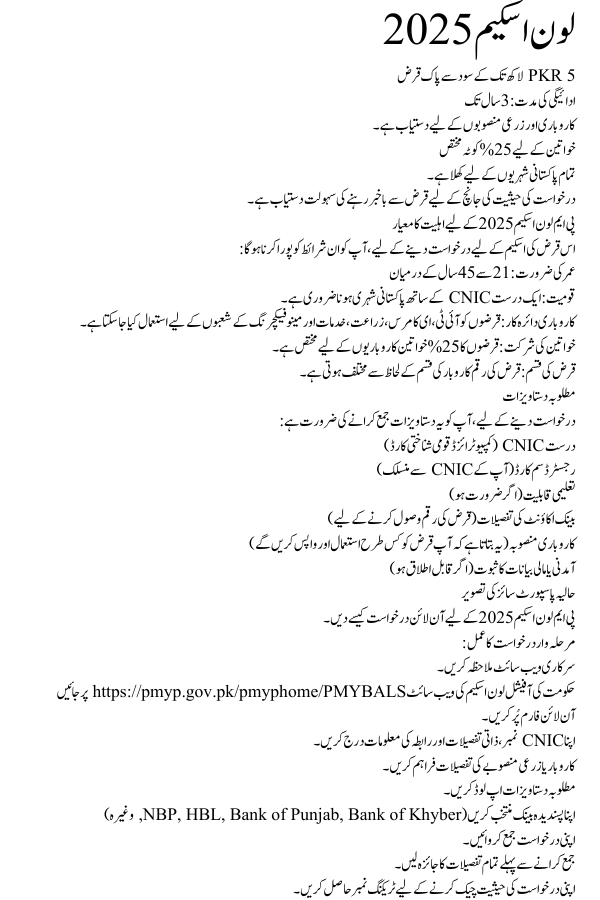

The Prime Minister Youth Business and Agriculture Loan Scheme is a government program designed to help young people start or grow their businesses and agricultural projects. This scheme is different from past youth loan programs and has specific rules and loan categories.

- Interest-free loans up to PKR 5 lakh

- Repayment period: Up to 3 years

- Available for business and agricultural projects

- 25% quota reserved for women

- Open to all Pakistani citizens

- Loan tracking facility available for checking application status

Eligibility Criteria for PM Loan Scheme 2025

To apply for this loan scheme, you must meet these conditions:

- Age Requirement: Between 21 to 45 years

- Nationality: Must be a Pakistani citizen with a valid CNIC

- Business Scope: Loans can be used for IT, e-commerce, agriculture, services, and manufacturing sectors

- Women Participation: 25% of the loans are reserved for women entrepreneurs

- Loan Category: The loan amount varies depending on the type of business

Required Documents

To apply, you need to submit these documents for Business and Agriculture Loan Scheme:

- Valid CNIC (Computerized National Identity Card)

- Registered SIM Card (linked to your CNIC)

- Educational Qualifications (if required)

- Bank Account Details (for receiving the loan amount)

- Business Plan (explaining how you will use and repay the loan)

- Proof of Income or Financial Statements (if applicable)

- Recent Passport-sized Photograph

How to Apply Online for PM Loan Scheme 2025

Step-by-Step Application Process:

- Visit the Official Website

- Go to the government’s official loan scheme website: Loan Scheme

- Fill Out the Online Form

- Enter your CNIC number, personal details, and contact information.

- Provide business or agricultural project details.

- Upload the required documents.

- Select your preferred bank (NBP, HBL, Bank of Punjab, Bank of Khyber, etc.)

- Submit Your Application

- Review all details before submitting.

- Receive a tracking number for checking your application status.

Loan Approval and Disbursement

- The government and bank will review your application.

- If approved, the loan amount will be transferred to your bank account.

How to Your Loan Application

Follow these steps to check your application status for Business and Agriculture Loan Scheme:

- Visit the loan tracking section on the official website.

- Enter your CNIC number, application number, and mobile number.

- Click on “Track Application” to see real-time updates.

- You will receive notifications about approval, processing time, and disbursement details.

Loan Repayment Structure

- No interest on loans up to PKR 5 lakh.

- Monthly installment plans are available.

- Loan tenure can be up to 3 years.

- Grace period may be provided before repayment starts.

- Use the loan repayment calculator on the official website to estimate your monthly instalment.

Important Considerations Before Applying

- Apply only for the amount you really need to avoid repayment difficulties.

- Ensure your CNIC and SIM card are valid and active.

- Provide accurate information to avoid legal issues.

- Read the terms and conditions carefully before submitting your application.